Publisher's Corner

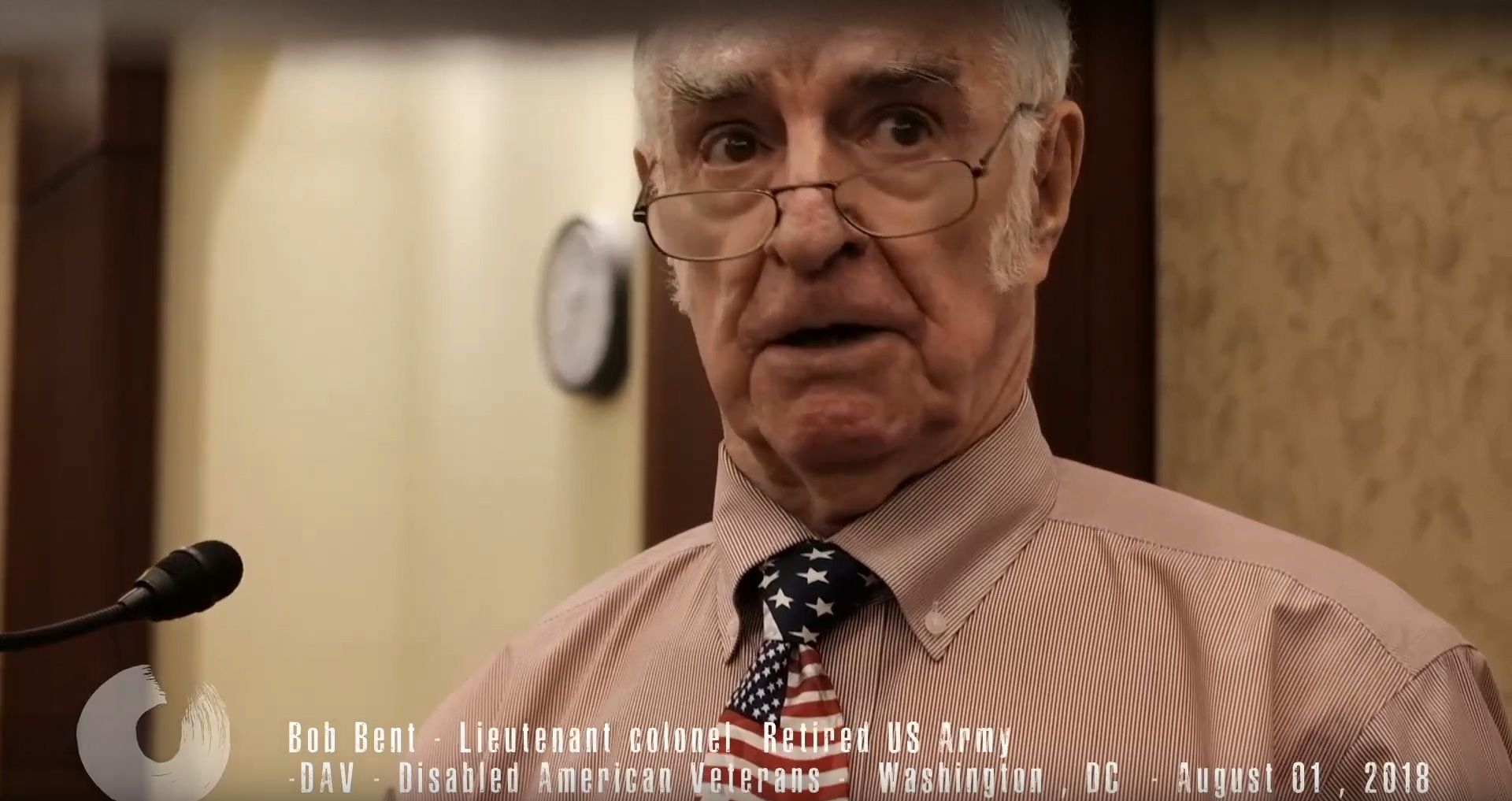

Guest Viewpoint

The American Foundation for Suicide Prevention and Zero Suicide - Meet the Staten Island Military, Veteran, Family (SMVF) Task Force!

Rewiring Veterans’ Money Mindset for a Stronger Financial Future

Transitioning from military service to civilian life can feel like entering an entirely different battlefield—one filled with hidden landmines of debt, unexpected expenses, and unfamiliar rules of engagement when it comes to money. Many veterans face financial struggles not because of laziness or lack of discipline, but because of how ingrained behaviors, survival-mode thinking, and outdated beliefs sabotage long-term success. The good news? Your mindset is not fixed—it’s moldable. Just as physical training reshapes the body, mental conditioning can rewire your approach to money.

Mental Pitfalls That Derail Your Wallet

Even the sharpest vets can fall prey to sneaky thought patterns that quietly derail their finances. One of the most common traps is favoring instant gratification over future rewards—think grabbing the latest gadget instead of building a rainy-day fund. Another major pitfall? Reacting emotionally to new financial info, like panic-selling stocks or jumping on get-rich-quick schemes. Many also overestimate their financial know-how, assuming they can “wing it” without a solid plan or education. And on the flip side, others are so afraid of loss that they never invest at all, leaving their money stagnant instead of growing.

Why Earning a Degree Can Be a Gamechanger

Investing in education is one of the most direct ways to increase your lifetime earnings, especially for veterans transitioning into competitive civilian careers. A degree doesn't just open doors—it builds confidence, upgrades your skill set, and shows employers that you’re serious about growth. Online programs now make it easier than ever to pursue a degree while managing a job or caring for family. And if you’re already in nursing, you can take things to the next level by earning your RN to BSN online, enhancing your clinical expertise and your paycheck at the same time.

Cultivate a Positive Money Mindset

The military taught you discipline, but chances are, nobody handed you a guide to financial healing. A good starting point? Forgive yourself. We all make mistakes with money—bad credit, impulse buys, lost opportunities. Let it go. Then, start getting honest about how emotions influence your choices. Fear, shame, pride, even guilt can lurk behind financial behaviors. Stop measuring your worth by someone else’s Instagram highlight reel. Your path is yours. Build habits slowly, like setting a weekly budget or checking your bank balance daily. Embrace the discomfort of learning new things—it’s the same grit that got you through boot camp.

Practical Ways to Earn More Money

Making more money doesn’t always mean picking up a second job, though that’s an option. Start by assessing your current skill set—what can you monetize? Maybe you’re a great mechanic, writer, or project manager. Side hustles like freelancing, consulting, or even reselling items online can generate extra income. Look into veteran-specific job training or small business grants—many organizations are eager to support your next chapter. If you’re working full-time, ask yourself if a raise or promotion is within reach. Sometimes, advocating for yourself is all it takes to increase your income.

Tactical Tips to Boost Your Savings

Saving money doesn't have to be a joyless slog. Start by automating it—set up your paycheck to deposit a portion directly into a savings account before you even see it. Next, get aggressive about identifying money leaks. That could be unused subscriptions, impulse food deliveries, or hidden banking fees. Challenge yourself to a no-spend week every month, focusing only on essentials. Use it as a training exercise. You can even gamify your goals: set small rewards for hitting saving milestones. And don’t forget to tap into military discounts and veteran perks. That extra 10–20% off adds up when used strategically. Remember, every dollar saved is a step toward freedom.

The Mental Weight of the Wallet

You already know how stress can grind you down—and finances are one of the biggest triggers. But it’s not just about having or not having money. It's about how you feel about money. If every dollar feels like a battleground, that’s not sustainable. Take time to journal or talk with a counselor about the deeper feelings money brings up. Is there fear? Resentment? Anxiety? Understanding your emotional baseline helps you build strategies that actually work for you—not ones based on guilt or social pressure. Therapy, financial coaching, or veteran peer groups can be a huge help. Healing isn’t just about the body. Your mind—and your money—deserve care, too.

Stop Comparing and Start Connecting

It’s tempting to look at what others have and feel like you're behind—but that mindset is a trap. Everyone’s journey is different, especially for veterans, whose paths often don’t follow the traditional playbook. Instead of comparing, try connecting. Join financial literacy groups for vets, engage with forums, or start your own accountability group. Sharing goals and being honest about setbacks in a judgment-free space creates a sense of camaraderie and direction. Your tribe should lift you up, not make you feel small. Iron sharpens iron—and you’re not meant to go at this alone.

No matter how long you’ve been out of uniform, your next mission is just beginning. It’s not about being rich or retiring early—though that’s great if it happens. It’s about reclaiming your power and giving your future self options. That starts with reshaping how you think, talk, and act around money. Let go of the shame, ditch the comparisons, and embrace small, consistent wins. You’ve already proven you have discipline, courage, and heart. Now it’s time to apply those same strengths to your financial life. Because the freedom you fought for? You deserve to feel it in your bank account, too.