Publisher's Corner

Guest Viewpoint

Well, that felt good.

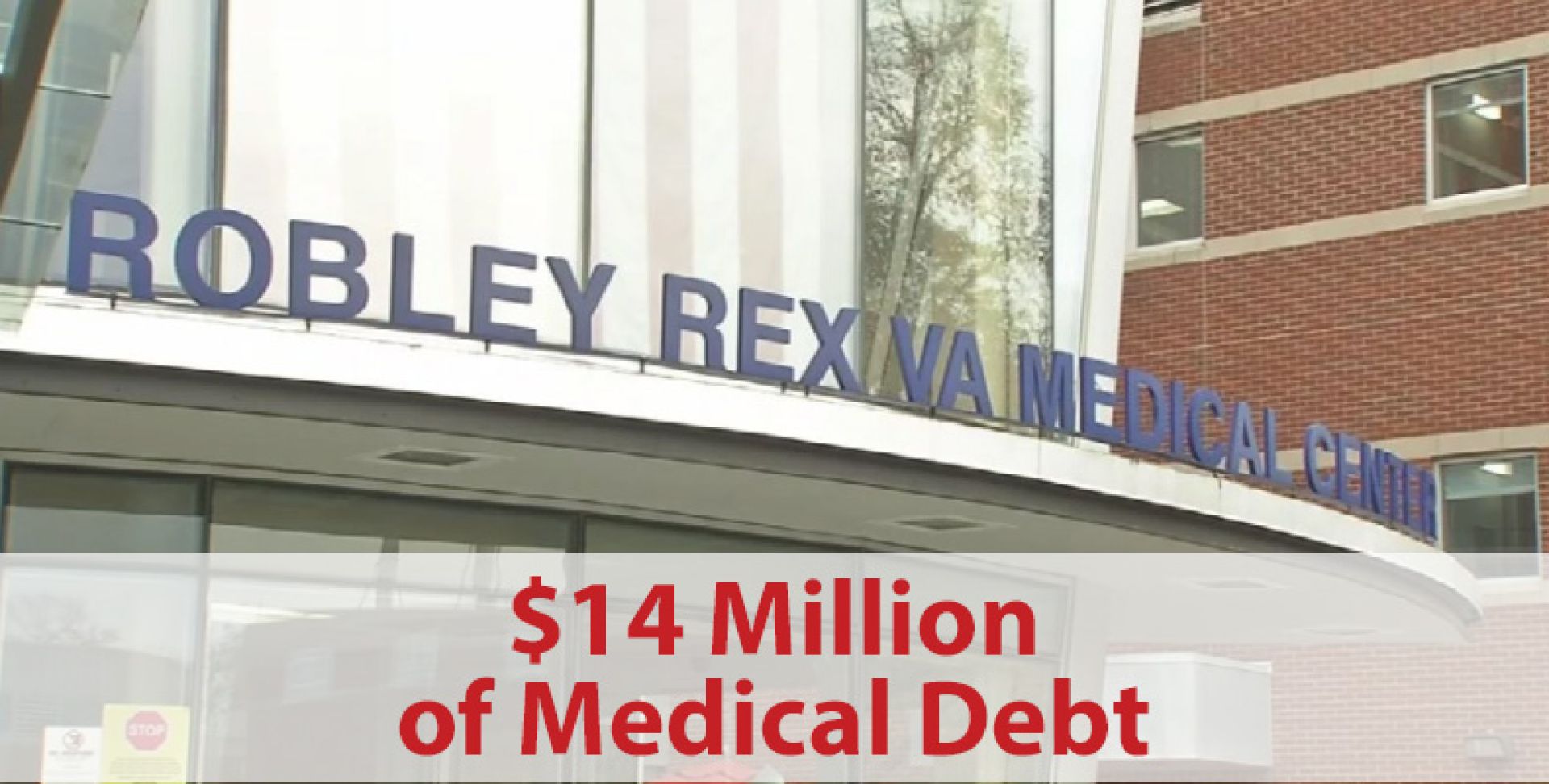

The Federal Government is Collecting Millions of Dollars from Struggling Veterans in Kentucky and Beyond

Veterans across the country are saddled with debt. A new nonprofit is launching this Veterans Day and wants to help.

This Veterans Day, many veterans and their families are struggling under the weight of debt tied directly to their service.

Veterans owe money to credit card companies, payday lenders or other predatory financial services that target servicemembers and veterans. A staggering amount of veterans’ debt is owed to the federal government itself in the form of overpaid benefits and unpaid medical bills to the Department of Veterans Affairs healthcare system.

It’s unclear just how much debt veterans owe across the country; federal officials could not provide data or answer emailed questions about outstanding debt in time for publication.

But data from the U.S. Treasury shows federal debt collectors in the past decade have clawed back more than a billion dollars from veterans who were overpaid on benefits or accrued medical bills after visiting a Department of Veterans Affairs medical center.

In Kentucky, they’ve collected nearly $14 million in medical debt that originated at Louisville’s Robley Rex facility and VA healthcare centers in Lexington, according to data from the federal Bureau of Fiscal Service.

The debt collection process utilizes all the powerful tools at the federal government’s disposal — withholding tax refunds, social security checks or other benefits payments.

A new group offers help

Jerry Ashton would like to see the debt wiped out.

This Veterans Day, he’s launching a nonprofit called End Veteran Debt to do just that. The group will work to free veterans of all kinds of debt, Ashton said. But the initial goal is to clear what he says is $6 billion in medical debt owed to the VA.

“I feel that once people have served our country that we're going to serve them in some fashion,” Ashton said.

Ashton, a veteran himself, has done this type of work before.

After he got out of the Navy, Ashton made a living as a debt collector, hounding people for money owed to banks, hospitals and credit card companies.

Ashton had retired by 2011, when Occupy Wall Street brought thousands of activists to Zuccotti Park, near where Ashton lived in New York City. There, Ashton connected with activists looking to do something about the staggering amount of medical debt in the U.S. That laid the foundation for RIP Medical Debt, the nonprofit Ashton co-founded to buy and forgive medical debt.

John Oliver highlighted RIP Medical Debt in 2016, bringing national attention to the group which has cleared over $10 billion dollars in medical debt since its foundation. And last year, he was featured on NPR.

Ashton said that he was surprised to see veterans among the list of people RIP Medical Debt had helped.

There’s urgency to the work, too, he said. Veterans often cite debt and financial issues as a contributing factor to severe mental health struggles.

But before he can get started, he needs some help from the federal government.

Right now, the group can’t purchase debt directly from the VA. So, Ashton will need a policy change to allow the VA to sell or donate medical debt directly to nonprofits with the intention of forgiving that debt.

It’s a change that has been made before. At one time, federal rules restricted RIP Medical Debt to purchasing medical debt only from third party debt buyers. Then, in 2020, the Department of Health And Human Services changed that rule — in response to a plea from RIP Medical Debt — and allowed the nonprofit to purchase debt directly from hospitals.

Ashton said the same kind of rule change would help his new organization help veterans more efficiently.

“We've abolished $130 million for the veteran debt by accident (through RIP Medical Debt),” Ashton said. “What can we do if we actually went in on purpose?”

Overpayment debts

Frank Bencomo, an attorney with the Legal Aid Society in Louisville, said this time last year he had never seen a veterans benefits overpayment case.

Now, he said the Legal Aid Society has about ten active cases before the VA.

From a conference room in the Legal Aid Society’s downtown office, Bencomo laid out a typical case:

A veteran will draw VA benefits — usually in the form of a pension or disability payments — as a compliment to other safety net systems such as social security.

If the amount paid to the veteran in social security increases, the amount the veteran receives in VA benefits is supposed to decrease accordingly, but it's the veterans responsibility to inform the VA of this change.

The problem arises, Bencomo said, if the veteran is unaware of the change in the first place, or unaware that they need to tell the VA. In other cases, Bencomo said the veteran may have informed the VA of the change over the phone, but the change won’t be recorded in the agency’s records.

The VA has struggled to make accurate benefits payments, and as recently as last week paused collections from nearly 40,000 veterans because it discovered the overpayments were caused by accounting errors spread out over 12 years.

Overpayments can go on unaddressed for years before the VA notices.

Once that happens, Bencomo said the veterans will get a letter describing the discrepancy. This letter will not say the total amount owed by the veteran, Bencomo said.

That number comes in a second letter, and Bencomo said the sums are often “massive.”

“Because usually the correction was a hundred dollars, a couple hundred dollars, every month, for a decade,” Bencomo said.

The Legal Aid Society, which represents people living at or below 200% the federal poverty guideline (currently $60,000 a year for a family of four), has represented clients with debts as large as $100,000.

Once that second letter arrives, the veteran has 30 days to pay the debt or the VA can start collecting using the most powerful debt collector in the world: The U.S. Treasury.

The Treasury will often withhold money from future benefits to pay off the debt, sometimes the entire value of the benefits. Bencomo said some of the debts are so large, and the benefits payments so small, that many people won’t come close to paying off the debt in their lifetimes.

In the meantime, the VA will deduct money from future benefits in perpetuity.

The impact can be harrowing, he said.

“We're looking at people who, most are elderly, all of them are low income, they may live off more than one avenue of support,” Bencomo said. “It's difficult because all these people, they served, they tried to make the best they can of their lives, and they've acquired their benefits honestly.”