Publisher's Corner

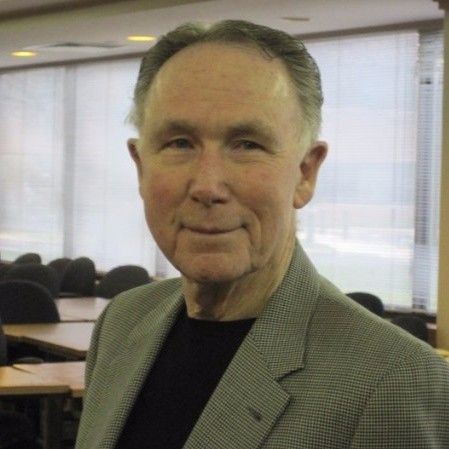

Guest Viewpoint

Well, that felt good.

The Seven Deadly Sins of America’s Debt Collection Practices

Video Credit: Patrick de Warren, In the Blink of an Eye, LLC.

The way that America’s veterans – and active-duty service members – are put into debt and then pursued for that debt is contributing to that community’s horrific rate of suicide. This unintended outcome of common industry practices needs to be made public, debated, and then resolved.

Health care professionals are just now recognizing this social determinant of suicidal ideation and the act itself as a “hidden in plain sight” contributor to this blight. As a Navy veteran journalist, also having three decades of experience in the collections industry, I am compelled to report on this.

So, in no order of importance – they are all important – let’s explore

#1. Debt collection, in and of itself, contributes to veteran suicides, according to recent studies.

Debt-related stressors from events like job loss, home foreclosure, run-ins with the law, domestic problems, and oftentimes relentless creditor pursuit are significant contributors to veterans killing themselves at the rate of 44 per day – 60% higher than that of civilians.

Although suicide exists in both communities, disparities between veterans and civilians continue to widen. The suicide rate among women veterans is 92% higher than that of non-veteran women. For male veterans, the rate is almost 60% higher than that of civilians.

This failure by the VA, charities, and veteran service organizations to make a dent in these stats is leading to a meaningful, national discourse involving major military and civilian organizations. It may be just in the nick of time.

#2. Placing, or keeping veteran debt – even medical – on credit reports.

When issues with credit reporting, debt collection, or medical billing are not resolved, the consequences for servicemembers and military families can include loss of housing, separation from service, denial of security clearances, and an inability to obtain government or civilian employment.

In 2021, servicemembers submitted more than 17,000 credit or consumer reporting complaints to the Consumer Financial Protection Bureau (CFPB), making it to the top of the list in complaints, far surpassing those of civilians.

#3. Collecting for corrupt or predatory lenders.

I have historically had a love-hate relationship with my own industry and was more than happy – hoping for correction – to point out its flaws and misadventures. Relative to predatory lenders, more than a decade ago I penned this article, Debt Collecting: Morally Neutral or Morally Bankrupt? in the industry magazine insideARM and posed the question, “If our client isn’t moral, why should we be?”

Department of Defense studies have found that service members are as many as four times more likely than civilians to be victims of high-interest-rate credit cards, car notes, and payday lenders, many of the latter clustering around military bases.

Research examining 20 states, 1,516 counties, 13,253 ZIP codes, nearly 15,000 payday lenders, and 109 military bases consistently found high concentrations of payday lending businesses in counties, zip codes in close proximity to military bases.

These lenders typically charge fees equal to 400% APR and even higher. Approximately 75% of payday loan customers are unable to repay their loans within two weeks, forcing them to obtain loan "rollovers" with larger loans and higher fees and interest rates.

For all-too-many collection agencies and debt buyers, it’s a profit center.

#4. Not having an Ombudsman.

Decades ago, as a consultant to the collections industry, I practically begged the powers that be at the time in the American Collection Association (ACA) to create an industry ombudsman.

It only made sense. Unresolved complaints about the industry’s practices led to the creation of the Fair Debt Collection Practices Act (FDCPA) in 1978, which proved incredibly unpopular – to bill collectors. Yet, for the past 40+ years, they have fought oversight.

To apply the words of the famous lyricist, “They didn’t listen, they did not know how. Perhaps they’ll listen now.” I humbly offer my name as a candidate should that position be created.

#5. Supporting the dismantling of the Consumer Financial Protection Bureau

This is an especially egregious, self-serving act by the collections industry. In my opinion, the CFPB is being stripped of its powers by the current administration because it is too good at what it does. And what it does is to punish industry-wide economic malfeasance, regardless of its source and applying fines to fit the offense.

Since its inception in 2011, its enforcement actions have brought more than $21 billion back to consumers who had fallen victim to abusive and illegal activity. As for the military and veteran world, the CFPB has protected thousands of military members, families and veterans from predatory lenders, effectively enforced the 36% rate cap on loans to service members and their families stipulated by the Military Lending Act, and recouped millions of dollars for veterans who were victims of fraud.

The cost-cutting geniuses at the Trump Administration gutted the watchdog agency this year, slashing staff and halting much of the work. With the CFPB no longer overseeing the misconduct of for-profit businesses, charities, and credit issuers, what could go wrong?

Did I mention that the CFPB does/did have an ombudsman in place?

#6. Reluctance to be part of the solution.

Every industry loves to police itself. Using the “bad apple” mantra, collectors bemoan the fact that others not so law-abiding or ethical – easily identified, I might add – are giving them a bad name.

Then why aren’t they working with the CFPB and consumer groups to identify and exorcise these demons? Why isn’t there an industry-wide effort to stand with the CFPB and consumer groups in righting clear wrongs? I have a very clear experience of that reluctance in the case of medical debt collections and reporting.

RIP Medical Debt (renamed Undue Medical Debt), the charity co-founded by me and Craig Antico in 2014, was met with extreme, even hostile, resistance. A number of the largest debt buyers in the US refused to sell us medical debt so that we could forgive it. Others complained that our charity was bringing unwanted attention. (Actually, a valid upset, considering the industry take-down by John Oliver, who in 2016 featured our work in a magical segment of his Last Week Tonight With John Oliver.)

Not so true today. Not after the positive waves created by RIP in abolishing over $22B in medical debt for almost 15M Americans over the past decade.

#7. Not focusing on making all forms of veteran debt available for erasure.

Let’s address America’s most vulnerable population – our veterans and military – and the range and impact imposed on them by unpaid and unpayable debt.

In 2017, Craig Antico (now founder of ForgiveCo, EVD’s vector in locating and purchasing veteran debt) and I traveled to DC to meet with a House subcommittee on veteran health. We went there to learn why we were finding veteran medical debt in the portfolios we were purchasing. How could that be?

We were politely informed that VA healthcare is “discretionary” and that patient claims that did not meet VA qualifications were denied. “How much has this added up to?’ we asked. “Over $6B,” they answered. No wonder veteran-incurred hospitals and healthcare bills end up in collections! $6B worth of tough luck, buddy.

A CFPB report notes that the VA recently reported a portfolio of $382 million in pre-pandemic debt for outstanding medical care, and that the agency’s debt collection activities would impact approximately 875,000 veterans. Is the VA considering ramping up collection efforts without considering the negative mental health impact?

Institution, heal thyself.

It’s going to take a lot of work to get our veterans out of “debt purgatory.”

It will take all of us, large or small, civilian or military, NGO’s or businesses, to dig us out of this mess. Consider this article not just a wake-up call, but an invitation to engage in a broader dialogue and potentially form a larger alliance or partnership. Were we to unite in this effort, how could we not prevail?

We’re already busy at work. On September 9, EVD delivered the opening shot with a well-attended “micro-summit” on suicide and debt at New York’s Fordham University. Through that event, we were invited to join the Financial Working Group of the nationally respected Face The Fight consortium.

Erase Veteran Debt – End Veteran Suicide.